CreditVana Review 2025| Is CreditVana Worth It for Free Credit Scores

CreditVana

Introduction

In a world where knowing your credit score can make or break your financial future, free and reliable credit-score tools are more important than ever. CreditVana claims to deliver 100% free credit scores, real-time monitoring, and smart credit tools — all with no hidden fees or subscriptions. But is CreditVana really as good as it sounds? In this review, we dig deep into what CreditVana offers, what users are saying, potential red flags, and whether it’s worth your time.

What is CreditVana?

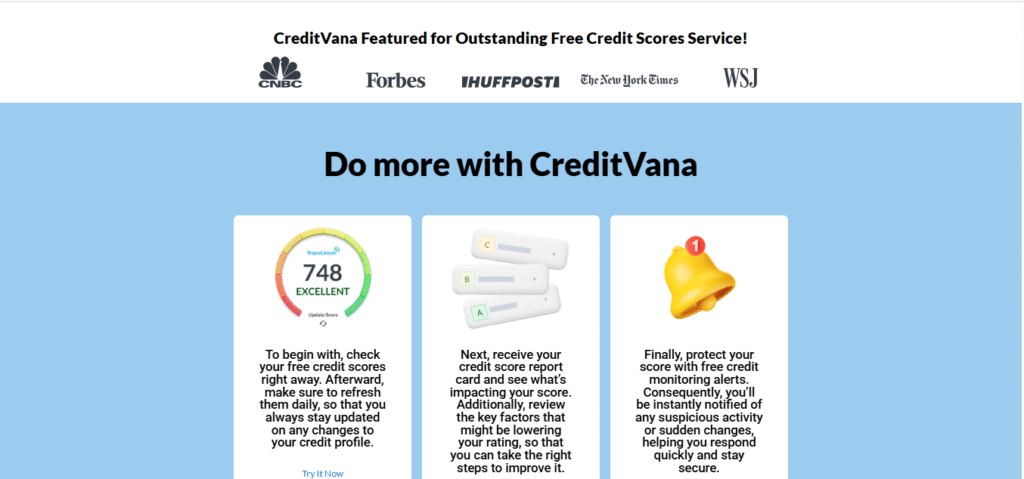

CreditVana is a platform (website/app) that promises free credit scores and credit monitoring. According to their site, you can:

- Get a credit score report for free. CreditVana+1

- Receive alerts if anything changes in your credit profile — helping you catch suspicious activity early. CreditVana+1

- Use tools to find credit cards or loan offers tailored to your credit profile. CreditVana+1

CreditVana markets itself as a “consumer-first” alternative to older credit monitoring services that require monthly subscriptions.

Key Features & Benefits

Here’s what stands out about CreditVana (or claims to):

- Free credit scores and reports — without the usual paywall many credit-score services put up. AB Newswire+2The Inscriber Magazine+2

- Access to bureau-level data (allegedly from major bureaus such as Experian, TransUnion, and Equifax) — CreditVana claims to pull scores directly from credit bureaus, giving a more accurate reflection of your credit standing. The Chronicle-Journal+2Digital Journal+2

- Clean, user-friendly interface and smart tools — A simpler, less cluttered experience compared to some older credit-score apps, plus tools to help match you with suitable credit offers. The Chronicle-Journal+1

- Credit monitoring & alerts — The service reportedly monitors changes and sends alerts if there are suspicious changes to your credit file. openPR.com+1

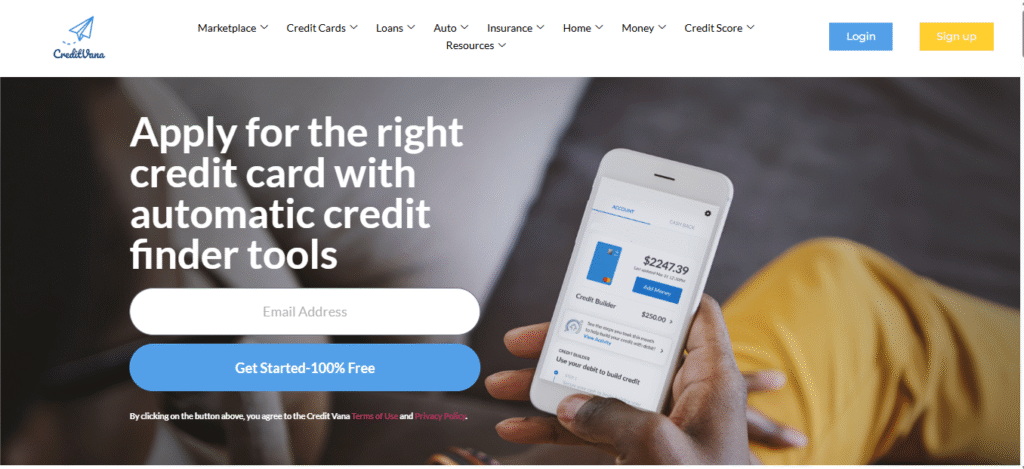

- Potential credit building and better financial decisioning — Through better visibility and credit-marketplace tools, users might make smarter decisions about loans or credit cards. Digital Journal+2The Chronicle-Journal+2

What Users Say: Reviews & Ratings

According to a user-review aggregator, CreditVana has a “Safety Score / Legitimacy Score” of 64.2/100 — indicating moderate confidence among users and reviewers. JustUseApp

- Some users report positive experiences, praising ease of use, quick access to credit information, and helpful monitoring tools. JustUseApp+1

- Others are less convinced — the “Negative experience” portion is non-negligible (about 35.8% in one snapshot). JustUseApp

This mixed feedback suggests while many find value in CreditVana, there are also concerns or limitations depending on user experience or expectations.

Potential Red Flags & What to Watch Out For

No service is perfect. Here are some caveats and potential issues to consider before trusting CreditVana completely:

- Although CreditVana claims to be free, there are external articles stating there might be a “premium account” (e.g. a $3.99 account) for boosted features. AB Newswire+1

- Some external evaluators highlight that the website has “average to good” trust scores — but also point out limited traffic/visitor data, shared hosting for sensitive data (which may raise security concerns), and lack of extensive reviews on major review sites. ScamAdviser

- As with many credit-score or financial tools, the accuracy and usefulness largely depend on whether your actual credit bureau data is correctly linked — so there’s always a chance of discrepancies or partial data.

- If you are using such services from Kenya (or outside the U.S.), compatibility, local relevance, or applicability of “credit bureaus data” may vary — you’ll need to check whether CreditVana supports your region properly.

Who Should Use CreditVana — And Who Should Be Cautious

Good candidate for CreditVana:

- Individuals in countries supported by CreditVana (check if your region is covered) who want to monitor their credit health regularly.

- People applying for loans or credit cards and wanting to check and improve their score before applying.

- Users looking for a low-cost or free alternative to traditional paid credit reporting services.

Be cautious / double-check if:

- You’re outside CreditVana’s supported region — bureau data and credit histories may not be accessible or relevant.

- You deal with sensitive financial data — confirm how data is stored, shared, or secured, especially given some external safety assessments flagged shared hosting.

- You expect full credit-bureau transparency — Real-time, accurate bureau data may not always match what lenders see, depending on region and data-sharing agreements.

Final Verdict: Is CreditVana Worth It?

CreditVana offers a compelling value proposition: free (or low-cost) access to credit scores, monitoring, and credit-marketplace tools. For many users — especially those seeking to build or track credit responsibly — it could be a useful, cost-effective solution.

That said, potential limitations (region compatibility, data-security concerns, mixed user feedback) mean it’s not a one-size-fits-all solution. If you’re in a supported region and willing to use it as one of several tools — rather than relying on it exclusively — CreditVana may be worth a try.

If you decide to proceed, treat it as one tool in your financial toolkit: regularly check your reports, verify accuracy, and combine it with other credit awareness practices.

Tips Before Signing Up with CreditVana

- Do a quick background check — look for recent user reviews and community feedback to gauge current reliability.

- Avoid entering highly sensitive data until you’re sure about data security (e.g. avoid entering full financial account numbers if not necessary).

- Use it as a monitoring tool, not a guarantee — always double-check with official credit bureaus (if available in your country) before major financial decisions.

- Combine with other financial good habits: timely bill payments, responsible use of credit, and building a healthy credit history over time.